The dust will eventually clear, but the 200-day moving average for the New York Stock Exchange Advance Decline line (NYAD) turned into a brick wall last week, and the CBOE Volatility Index (VIX) says there is more trouble ahead for stocks.

Powell Does the Job

Stocks bounced back from their options expiration induced swoon midweek, but turned lower once again on 8/26/22, when Fed Chair Jay Powell, at the Fed’s Jackson Hole, Wyoming annual confab, noted the central bank would likely keep interest rates high for “some time,” while suggesting that the central bank’s next moves would likely cause “pain.”

Moreover, the latest inflation data suggests that, although the rate of rise has slowed, inflation is not going away just yet as the post-pandemic and war in Ukraine era evolves. That’s because the structural nature of the underlying problem, too much demand and not enough supply, isn’t going away anytime soon, no matter how much the Fed raises rates. Therefore, even though there are still reasons to own certain stocks in this market, the pickings may be slim, as the current structural problems in the global economy require solutions which could take years to sort out.

On the positive side, the companies who can address these problems will flourish, though others may not do well. For the foreseeable future, I’ll be focusing on those whose industrial niches are most likely to pay off.

I’ve been adding these companies to the Joe Duarte in the Money Options portfolios lately. You can have a look at them here.

How Did We Get Here?

Beginning in the early 2000s, money began flowing out of the U.S. and Europe into China as companies looked to increase profits by reducing their exposure to rising labor costs and taxes. This turned China into the world’s manufacturing hub and created a world where inflation was controlled.

The defining phrase of the era was “just in time” supply chain management, where production and consumption marched hand in hand and efficiency was rewarded with rising profits. The advent of software and artificial intelligence to automate great swaths of the process added to the system’s ability to maintain lower costs and rising profits. A bonus effect was the efficient coordination and management of the supply chain.

Unfortunately, the COVID pandemic put an end to the “just in time” dynamic by exposing its gross faults. First, “just in time” manufacturing and supply chain management had no redundancy. That meant that, when one link in the chain misfired, the chain ground to a halt.

Moreover, by transferring its manufacturing capacity to China, Europe and the U.S. became vulnerable to China’s own interests. This worsened when China pursued its “zero COVID” policies, which featured rolling shutdowns, and was pushed totally over the edge when Russia invaded Ukraine.

All of this led to supply chain disruptions and the realization that there was a need to repatriate manufacturing capacity to the U.S. and Europe. Unfortunately, policy makers and CEOs seem to have figured this out a bit late in the game, which means that it’s going to take a while to reverse the dynamic, if it’s reversible at all.

And here is one final thought. Only some of the manufacturing capacity has begun to be transferred to the U.S. and Europe. A large portion is moving from China to Vietnam, India and the Balkans.

What could possibly go wrong?

Where Do We Go Next?

Consider the following:

The war in Ukraine isn’t likely to end any time soonChina’s economic troubles and COVID policies aren’t going awayChina’s environmental crisis and long-term demographics will hamper their labor marketEurope’s energy problems are only likely to worsenBecause of Europe’s and China’s problems, global energy supply is unbalanced and under stress and global supply chains are brokenRepatriation and relocation of resources won’t happen quicklyNature and geopolitics – drought, increasing difficulty in natural resource availability and increasing political polarization, will make everything harder to achieve

The data suggests that a difficult few years may lie ahead, as there aren’t enough factories or production facilities that are available to produce goods. There aren’t enough workers to do the work. Natural cycles will make progress slower than hoped for.

The Central Theme is Energy

If there is an element that binds everything in the global economy, it’s reliable energy. And with the difficulties faced by carbon sources due to policy changes, along with the general state of the energy sector and related industries due to their responses to policy decisions and their search for profits, the solution for the intermediate future may be nuclear energy.

Of course, past disasters such as Fukushima, Three Mile Island and Chernobyl are proof that nuclear energy is high risk. Nevertheless, given the difficulties with the current alternatives, from an investment standpoint, the sector is worth considering.

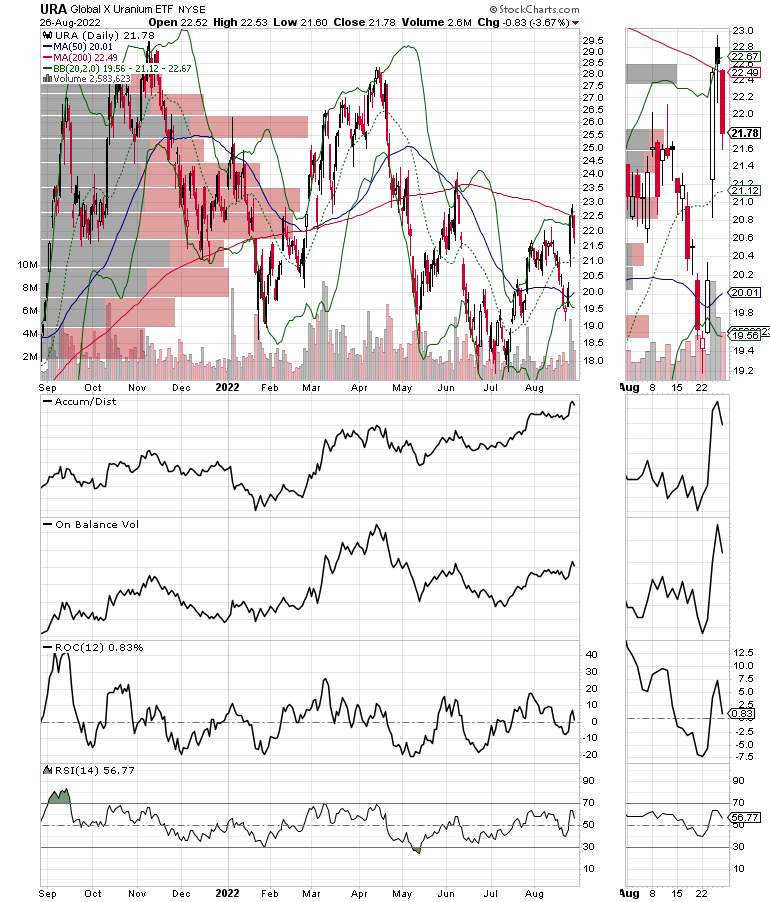

I’ve been bullish on oil and natural gas stocks for some time now. But I recently recommended purchasing shares in the Global X Uranium ETF (URA), as I expect that will be the next sector that flourishes.

In fact, Japan is considering the reversal of its nuclear plant shutdowns, and I expect that, after what could be a disastrous winter for Europe, other countries will soften their positions against this controversial power source.

Thus, for investors who can be patient, this ETF provides a one-stop shop for owning the sector as it includes companies that mine and process uranium, as well as nuclear fuel and waste transportation and processing companies. Moreover, the diversification will help to offset the potential for individual company potholes, such as earnings misses.

The ETF has been under aggressive accumulation lately, as Accumulation Distribution (ADI) and On Balance Volume (OBV) illustrate. In addition, it is now testing the key resistance area of its 200-day moving average.

Owning this ETF will require some patience, as there are still lots of roadblocks regarding nuclear energy. But if you’ve got the time, the odds of an excellent payoff are on your side.

Bonds Yields Hold Near Key Chart Point

The bond market seems a bit undecided about what’s next for inflation, which means that perhaps they are starting to believe that Powell really means business. Moreover, the bond market seems to be waiting for the signal that recessionary forces are gaining strength.

The U.S. Ten Year Note yield (TNX) remained above its 50-day moving average and the important 3% yield, but it did not tick decidedly higher after Powell’s speech. Meanwhile the Eurodollar Index (XED) remained stable.

This suggests that the bond market may now be considering that Powell may have fewer interest rate hikes in the works, as the economy is about to turn lower, or that perhaps the slower rate of growth in inflation will continue.

Interestingly, the Eurodollar market remained relatively stable, despite Powell’s hawkish speech. In this case, the best you can say is that it could have been worse, as XED slid early in the week, but didn’t crash during Powell’s speech. That’s a small positive, as a stable Eurodollar market bodes well for system liquidity.

You can get a working overview of how this works in my latest Your Daily Five video here.

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

Market Breadth Remains Volatile Around 200-Day Moving Average

The New York Stock Exchange Advance Decline line (NYAD) ran into heavy resistance at its 200-day moving average, as the Powell speech crushed the stock market.

The CBOE Volatility Index (VIX) moved further above 25, a fairly aggressive move higher, which suggests the downside for stocks still has some more legs. This is the result of put option buyers adding to their positions from options expiration and market makers hedging selling via by selling stocks, ETFs and stock index futures.

The S&P 500 (SPX) remained above 4000 and its 50-day moving average, the next big test of support. SPX clearly failed miserably in its attempt to climb above the 200-day moving average. Accumulation Distribution (ADI) has topped out, meaning that short sellers are back. On Balance Volume (OBV) is not showing any positive signs at the moment.

The Nasdaq 100 index (NDX) crashed below 13,000 and its 20-day moving average. Accumulation Distribution (ADI) is heading down as short sellers are coming back, and On Balance Volume (OBV) turned lower, which means sellers are bailing out.

Which is the best-looking energy stock at the moment? Find out with a FREE trial to my service (click here) and learn more about my risk-averse approach to trading stocks.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition – Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.